The Companies Act 2013 established substantial reforms to corporate governance through its replacement of India’s previous Companies Act of 1956. This Act works as a framework that aims to strengthen corporate governance alongside increasing transparency, while maintaining accountability for corporate entities in India. New federal legislation contains corporate compliance obligations that affect all businesses, including startups through multinational corporations.

The article elaborates on the Companies Act 2013 sections while analyzing its influence on corporate governance and explaining the necessary corporate compliance standards for Indian businesses.

Introduction to Companies Act 2013

On August 29th, 2013, the Companies Act 2013 designated new operational policies that fundamentally transformed the running of Indian enterprises. This Act controls all aspects of company creation and service duties as well as business termination procedures. Within its provisions, the Act requires corporate managers to adopt accountability standards while establishing contemporary frameworks to guide corporate governance practices.

The main goals which guide the Companies Act 2013 consist of:

- Promoting transparency

- Strengthening investor protection

- Ensuring strict corporate compliance

- Enhancing the ease of doing business

Structure and Scope of Companies Act 2013

The Companies Act 2013 features 29 chapters and 470 original sections, which have been modified through further amendments. Every company type, including public and private, together with one-person and Section 8 companies, falls under the Companies Act 2013 coverage.

The Act applies to:

- Companies incorporated under the Act

- Insurance, banking, and electricity companies (with exceptions)

- International organizations that operate in business activities inside the territory of India

Key Sections of Companies Act 2013

The Companies Act 2013 features sections and provisions that have direct effects on corporate governance and corporate compliance. The following items represent the most influential sections:

Section 2 – Definitions

The foundational definitions in this section clarify key concepts, which include company and director, together with memorandum and articles and share capital, among others, for maintaining corporate compliance standards.

Section 3 – Incorporation of Company

The procedure for incorporating various business forms in India exists within this section, making it easier to maintain corporate compliance during establishment.

Sections 4 & 5 – Memorandum and Articles of Association

The company needs these documents as its main fundamental legal blueprints. Organizations must strictly follow their constitutional documents so they can uphold proper corporate governance according to the Act.

Section 12 – Registered Office of the Company

After incorporation, every company needs to establish its principal location within a thirty-day period. Companies must inform the Registrar of Companies about any office changes to ensure corporate compliance.

Section 42 – Private Placement

According to this section, companies must establish thorough procedures during private security issues to maintain integrity and compliance with corporate requirements.

Section 135 – Corporate Social Responsibility (CSR)

The Companies Act 2013 introduced Section 135, which makes CSR spending mandatory for qualified companies to boost their corporate governance role in society.

Section 149 – Board of Directors

The details concerning board structure alongside its make-up are provided in this section. Every company must have at least one woman director, and the specific number of independent directors under this section, which enhances corporate governance standards.

Section 168 – Resignation of Director

This section creates a transparent organizational transitionCompanies operating under the provisions of the Companies Act 2013 must adhere to particular corporate compliance obligations.

Section 177 & 178 – Audit Committee and Nomination & Remuneration Committee

These subsections establish the necessary formation of essential board committees, which form an essential component for maintaining sound corporate governance and ethical oversight.

Section 184 – Disclosure of Interest by Directors

Enterprise directors need to reveal their interests in external entities so that ethical conduct remains strong throughout corporate governance structures.

Corporate Compliance Requirements Under Companies Act 2013

The Companies Act 2013 provides clear corporate compliance conditions that all companies must meet throughout different periods. Failure to comply will lead to expensive fines alongside the disqualification of directors and potential terms of imprisonment.

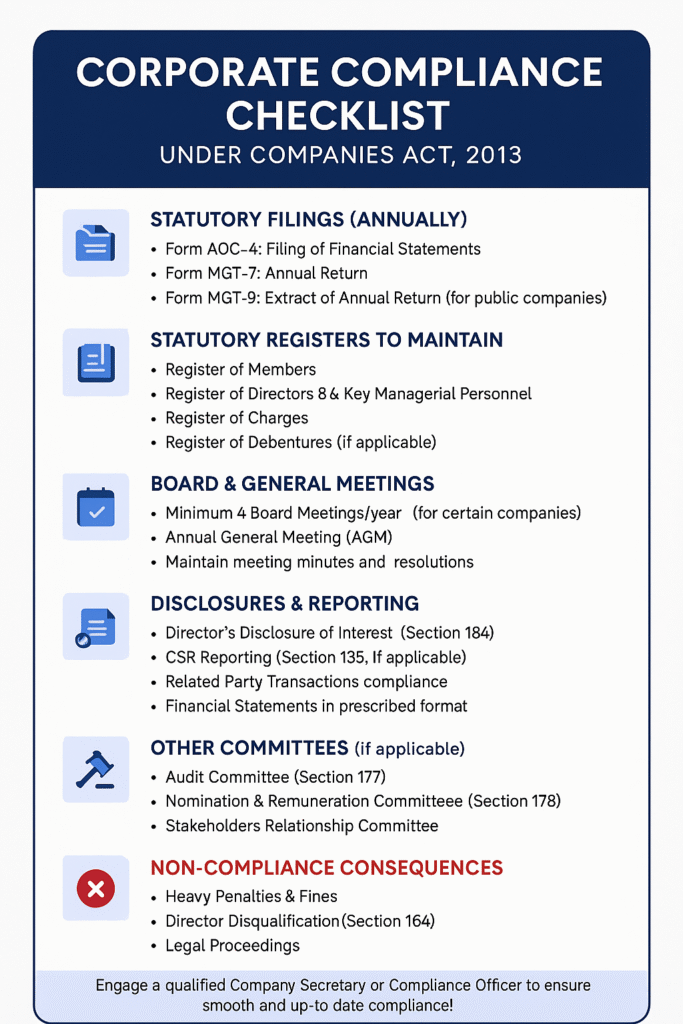

Annual Filings

A company must submit seven primary filings each year, including financial statements and annual return, together with an Extract of the Annual Return.

- Form AOC-4: Financial statements

- Form MGT-7: Annual return

- Form MGT-9: Extract of the annual return

These financial reports play a critical role in corporate compliance because they establish full financial disclosure according to the Companies Act 2013.

Maintenance of Statutory Registers

All companies are obligated to keep their registers on the following documents properly updated:

- Members

- Directors and key managerial personnel

- Charges and debentures

- Companies that maintain their records properly meet the requirements of corporate governance.

Conduct of Board and General Meetings

The Act mandates:

- At least four board meetings in a year (for certain companies)

- Annual General Meeting (AGM) for shareholders

Corporate compliance requires proper documentation that combines meeting documentation with formal minutes recording.

Appointment of Auditors

The Companies Act 2013 prescribes that companies need to select external auditors who will serve for a duration of five years through Section 139. The Companies Act requires particular company classes to have their auditor rotation as a measure to enhance ethical corporate governance practices.

Importance of Corporate Governance in the Companies Act 2013

The governance of a company relies on a system of principles and processes that provide standards for organizational management control. Several sections of the Companies Act 2013 present rules that enhance corporate governance by imposing:

- Board independence and diversity

- The Companies Act of 2013 requires companies to establish mandated risk and remuneration committees that are part of the board.

- Statutory disclosures and transparency in decision-making

- Whistleblower protection (Section 177)

The implementation of corporate governance practices leads organizations to enhance investor confidence and establish ethical organizational functions and behavior.

Penalties for Non-Compliance

Organizations that fail to comply with corporate standards will face considerable financial fines under the Companies Act 2013.

- Fines ranging ₹50,000 to ₹25 lakh

- Imprisonment for directors and officers in case of serious violations

- Disqualification of directors under Section 164

Corporate compliance difficulties can be avoided through thorough checklist maintenance combined with regular audits by companies, by making every director’s resignation public in order to comply with strict corporate governance regulations.

Amendments and Updates in Companies Act 2013

It has, over the years, been amended to make procedures simpler and to ease businesses. Some major reforms include:

- Decriminalization of minor offences

- Relaxation in compliance for startups and small companies

- Web-based filing system introduction for smooth corporate compliance.

Keeping up with such changes is imperative to have the company running properly, and lawyers are in order as well.

Role of Company Secretaries and Compliance Officers

In providing the mandatory corporate governance framework required by the Companies Act 2013 to ensure the company’s corporate compliance by professionals, such as the company secretary. They help:

- Draft resolutions

- File all the required forms with the RoC.

- Conduct board and shareholder meetings

- Advise on corporate governance practices

However, large corporations normally designate a compliance officer to oversee this job.

Companies Act 2013 vs. Previous Companies Act (1956)

The emphasis in Indian corporate legislation changed with the 1956 Companies Act being, more or less, replaced by the 2013 Companies Act. In part, this may be due to the fact that the 1956 Act was comprehensive at the time, while rapid changes in global corporate governance, transparency, and the protection of investors required that the 1956 Act be updated.

1. Corporate Governance and Compliance

The Companies Act 2013 places a stronger emphasis on corporate governance and corporate compliance. It mandated Independent Directors, in some cases, the requirement that a woman should be on the board of such companies, and specified Board Committees such as the Audit and Nomination & Remuneration Committees. The additions to these are to ensure such accountability and healthy decision-making.

The 1956 Act also had no detailed governance norms of the kind it has had subsequently, implying that it provided more flexibility to the promoters and far fewer safeguards to the minority shareholders or transparency of the functioning of the board.

2. Simplification and Modernization

In the 2013 Act, the regulatory framework is simplified. However, concepts of One Person Company (OPC), Small Companies, and Dormant Companies were introduced to empower startups and entrepreneurs, which were not there under the old law. Business processes were digitized to ease the process of business.

3. Strict Penalties and Compliance Monitoring

The 2013 act of enforcement carries much stricter penalties for non-compliance, fraud, and understatements. Corporate compliance has come under statutory filings, disclosures, and auditor accountability. While the 1956 Act was detailed, it was not so stringent in enforcement.

4. Corporate Social Responsibility (CSR)

The CSR clause (Section 135) is indeed one of the landmark provisions of the 2013 Act, requiring eligible companies to have to spend a certain proportion of profits on social welfare. In the previous law, no such thing was present at all.

In basic terms, the Companies Act, 2013 is a forward-thinking, compliance-driven legislation harmonizing Indian corporate law with the global guidelines centered on transparency, governance, and shareholders’ interests.

Conclusion

The Companies Act 2013 is essentially a landmark act that provides a comprehensive legal structure for conducting business in India. Because of its categorical focus on corporate governance, ethical conduct, and heavy reliance on corporate compliance, India is drawing closer to international corporate norms.

If your business is not a legal obligation, but a strategic move to build investor trust and long-term sustainability, it only makes sense to understand the key sections and meet the requirements.

As a company promoter, director, investor, or corporate professional, it is important to stay updated with this Act and follow high standards of corporate compliance and corporate governance in today’s business environment.

FAQs for Companies Act 2013

- 1. What is the Companies Act 2013?

The Companies Act 2013 is the primary legislation governing company formation, operation, and regulation in India, focusing on enhanced corporate governance and stricter corporate compliance norms.

- 2. How is the Companies Act 2013 different from the 1956 Act?

The Companies Act 2013 introduces modern concepts like Independent Directors, CSR, and digital compliance, unlike the 1956 Act, which lacked strong corporate governance mechanisms.

- 3. What is corporate compliance under the Companies Act 2013?

Corporate compliance refers to fulfilling all statutory requirements such as annual filings, maintaining registers, board meetings, and disclosures mandated by the Companies Act 2013.

- 4. Why is corporate governance important in the Companies Act 2013?

The Act enforces corporate governance to ensure transparency, accountability, and fairness in company management, protecting the interests of stakeholders and investors.

- 5. What are the penalties for non-compliance under the Companies Act 2013?

Non-adherence to corporate compliance rules can lead to heavy fines, imprisonment, and disqualification of directors under the Companies Act 2013.

Pingback: Influencer Marketing Laws in India (2025) – Know Your Rights

Pingback: Top Trading Rules in the Stock Market Every Investor Must Know

Pingback: Ultra Vires in Corporate Law: Everything You Need to Know (2025)

Pingback: Banking Regulation Act 1949: A Complete Legal Insight - The Legal Veda

Pingback: How to File a Consumer Complaint Online in India: Complete Guide

Pingback: Best AI Tools for Legal Companies in 2025: A Complete Guide - The Legal Veda

Pingback: Neurotechnology & Brain-Data Rights: The New Privacy Battle

Pingback: Tech Startups and the Future of Autonomous Vehicles

Pingback: CSR Lapses Now Lead to Harsh Section 135 Penalties

Pingback: Right to disconnect India Law Explained with Powerful Insights

Pingback: What Is Corporate Law: Essential Guide to Business Growth