The current global economy leads numerous people along with companies to generate income across multiple countries. NRI salaries and Indian business operations that carry out international activities create two taxation obligations which create financial strain for these entities. The Double Taxation Avoidance Agreement (DTAA) functions as a relevant mechanism.

Two nations sign Double Taxation Avoidance Agreement (DTAA) as treaties to stop income from receiving duplicate tax assessments. This article examines what DTAA represents along with its operating methods alongside the essential advantages of DTAA India.

What Is Double Taxation?

The tax system considers double taxation legitimate when a single income leads to tax payments from two separate nations. The UK together with India will levy income taxes on interest earned by an Indian resident in the UK. The scheme results in extra taxation burden for businesses which causes them to avoid international employment.

Countries remedy double taxation through the establishment of Double Taxation Avoidance Agreement (DTAA) to ensure income taxes apply properly only once to prevent conflicts.

What Is a Double Taxation Avoidance Agreement (DTAA)?

Countries establish Double Taxation Avoidance Agreement (DTAA) to create international rules for taxation of border earnings through bilateral arrangements. The agreement prevents tax paying individuals from being taxed for their revenue more than once.

The DTAA benefits individuals and entities by:

- Lowering tax liability

- Reducing withholding tax rates

- Preventing tax evasion

- Promoting foreign investments

DTAAs exist with individual characteristics that specify which types of income they address and clarify taxation percentages as well as methods to receive tax benefits.

Why is DTAA Important?

The Double Taxation Avoidance Agreement (DTAA) maintains a vital position in the international tax planning framework. Through fair taxation treatment DTAA enhances the economic connections between participating countries. The essential purposes behind DTAA importance include:

- The system prevents taxes from being paid on the same earnings twice

- Promotes trade and international business

- Offers clarity on tax liabilities

- The law stops people from hiding money from tax authorities.

The Double Taxation Avoidance Agreement (DTAA) helps non-resident Indians and worldwide companies lower tax obligations while giving them a stable legal framework.

Types of Relief Under Double Taxation Avoidance Agreement (DTAA)

Double Taxation Avoidance Agreements (DTAA) provide people with these two main ways to save on taxes:

Exemption Method

When this tax system runs income must pay taxes in one country and avoid taxes altogether in the other.

Tax Credit Method

The tax credit method permits taxpayers to pay taxes in multiple countries but gets tax credits from their home country for taxes already paid overseas.

The Indian Double Taxation Avoidance Agreement applies both methods depending on each individual tax treaty.

DTAA India: What You Should Know

DTAA India stands for the set of tax treaties that India has created with international nations. These agreements prevent both Indians who work abroad and foreign workers who work in India from paying taxes twice in multiple locations.

India has established double tax avoidance agreements with more than 90 nations. The DTAA system connects India with major world economies through tax agreements with the USA, UK, Germany, France, UAE, and Singapore.

When you have DTAA India you receive these essential tax agreement benefits:

- Reduced TDS on foreign income

- When you pay foreign taxes your home country allows you to receive tax credit

- Full or partial exemption on specific income types

- Promotes inbound and outbound investments

Key Double Taxation Avoidance Agreement (DTAA) Benefits for NRIs and Companies

Taxpayers from India and other DTAA countries receive the most important benefits of tax relief and cross-border investment help.

Avoidance of Double Taxation

The Double Taxation Avoidance Agreement exists to stop you from paying taxes on your income multiple times and make you earn more profits.

Lower TDS Rates

The DTAA between India and other countries cuts the income tax deducted at source when people receive interest dividends or royalties. The treaty between India and the USA lowers tax deductions on interest payments to 15%.

Tax Credits and Exemptions

When taxpayers declare foreign taxes paid they receive a tax credit to decrease their total tax amount in India.

Increased Cross-Border Investments

The DTAA helps investors make positive tax decisions that draw more foreign investment into their market.

Encourages Global Workforce Mobility

Employees and companies can expand cross-border operations without facing heavy tax responsibilities in both nations.

How Double Taxation Avoidance Agreement (DTAA) Works: Step-by-Step Guide

We will explain the Double Taxation Avoidance Agreement (DTAA) structure through a basic illustration.

A resident of India who makes $10,000 in interest income from the USA can benefit from this agreement.

- Under U.S. tax regulations the withholding tax rate stands at 30%.

- India-USA DTAA lets companies deduct TDS at 15% rate as specified.

- India also taxes global income

With DTAA India, the taxpayer:

- Pays 15% tax in the USA

- During tax filing in India this person receives a tax benefit that equals 15% of the total amount.

- Pays only the balance tax as per Indian rates, if any

Through these agreements the taxpayer avoids paying taxes twice on their same income.

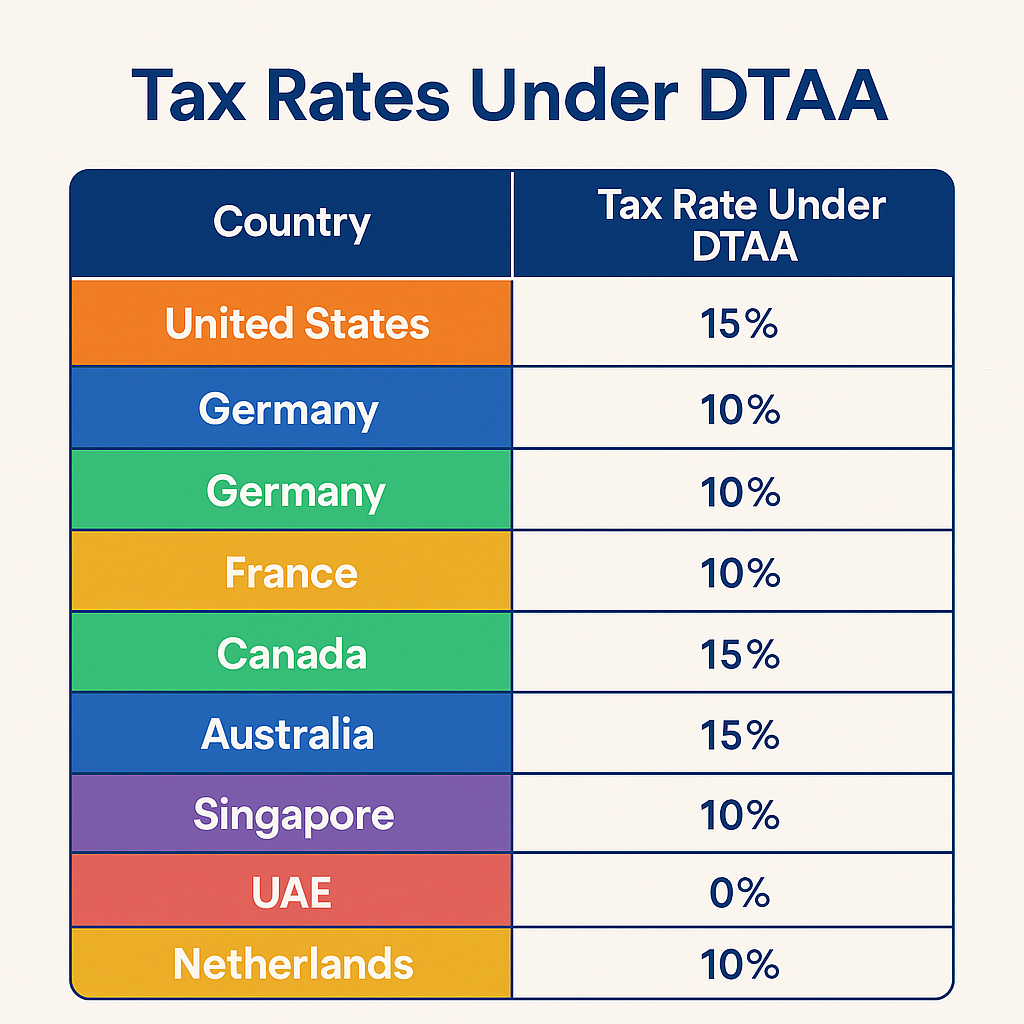

DTAA Countries List (As per India)

Here is a snapshot of the DTAA countries list that India has signed agreements with:

United States

United Kingdom

Germany

France

Canada

Australia

Singapore

UAE

Netherlands

Mauritius

Japan

South Korea

Russia

Each of these tax treaties has specific clauses and tax rates. The DTAA countries list continues to expand as India grows its international trade and diplomatic relationships.

DTAA India: TDS Rates Table

Income Types Covered Under Double Taxation Avoidance Agreement (DTAA)

This Agreement aims to handle tax matters for regular wages and salaries, interest dividends, royalty payments, technical fees, capital gains, salary retirement funds, and company earnings.

- Salaries and wages

- Interest income

- Dividend income

- Royalties and technical fees

- Business profits

- Capital gains

- Pension and retirement income

Every DTAA India agreement has unique requirements and regulations which you must confirm through official treaty documents or seek professional tax assistance.

Documents Needed to Claim DTAA Benefits

You need specific documents to use the DTAA benefits during your Indian tax reporting.

- You need to show proof of foreign nation tax residency plus TRC verification

- Form 10F

- You must show your personal tax statements and payment records.

- Copy of passport or PAN

The necessary documents verify tax compliance and make income eligible either for reduced tax rates or complete tax exemptions through DTAA India.

Common Challenges and Misconceptions

The Double Taxation Avoidance Agreement (DTAA) shows several important setbacks in its operation:

- Only a selected set of income falls under its protection

- Compliance requires detailed paperwork

- Treaty interpretation can be complex

- Changes made to international treaty agreements will usually ruin the advantages provided under DTAA.

Still, the long-term advantages of DTAA for global professionals and companies far outweigh the drawbacks.

Latest Updates on DTAA India (2025)

The Indian government will update tax treaties in 2025 to eliminate weaknesses and stop people from taking advantage of them. Key changes include:

- The government now demands stronger compliance for treaty benefits acceptance

- The tax authority needs to submit better disclosures about the tax arrangement.

- Implementation of anti-abuse provisions

The Indian government is adding stronger rules to DTAA India systems for true taxpayers to continue receiving DTAA benefits.

Conclusion

Anyone who deals with income between different countries needs the power of a Double Taxation Avoidance Agreement (DTAA). The agreement blocks both nations from collecting taxes when you earn identical income. DTAA proves valuable for NRIs, online workers, international organizations and international investors because of its real world advantages.

DTAA India’s presence in over 90 treaties among its member nations makes international commercial exchange and investment easier for everyone. The Double Taxation Avoidance Agreement (DTAA) benefits taxpayers who work for international clients or earn money from foreign sources while doing business in India.

Regularly verify if you can benefit from treaty regulations and use them effectively through professional tax guidance.

FAQs for Double Taxation Avoidance Agreement (DTAA)

- 1. What is a Double Taxation Avoidance Agreement (DTAA)?

A Double Taxation Avoidance Agreement is a treaty between two countries to prevent the same income from being taxed twice, ensuring fair taxation for individuals and businesses.

- 2. What are the main DTAA benefits for Indian residents?

Key DTAA benefits include reduced TDS rates, tax exemptions, and credits for taxes paid abroad, helping Indian residents avoid paying double taxes on foreign income.

- 3. How does DTAA India help NRIs?

DTAA India allows NRIs to claim lower tax rates or tax credits on income earned abroad, making it easier to manage taxes across countries.

- 4. What types of income are covered under tax treaties?

Tax treaties generally cover income like salary, interest, dividends, royalties, capital gains, and pensions, depending on the terms of each Double Taxation Avoidance Agreement.

- 5. Which countries are included in the DTAA countries list with India?

The DTAA countries list includes the USA, UK, UAE, Singapore, Germany, Australia, and over 90 others that have signed tax treaties with DTAA India.

It’s very straightforward to find out any matter on web as compared to textbooks, as I found this post at this site.

There is certainly a lot to learn about this issue. I love all the points you made.